Investors generally pay too little attention to the fees they pay on their mutual funds. Be it because they do not see the point, because they think there is no choice, or because they expect higher cost to mean higher quality.

The average annual cost of stock mutual funds is 2.6%, 1.6% for bonds and 0.8% for the money markets.1 Bonds returned 3.4% per year after inflation from 1952 to 2002, 7.2% for shares and 1.8% for cash.2 (I use French numbers, but this is likely to be fairly typical of the situation in most countries.) If you invest in money markets or bonds, half your gains therefore end up in the pocket of the fund manager.

Even a seemingly attractive investment can be pretty bad if you pay exorbitant fees for it. With inflation at 2.5% and fees at 3.3%, a nominal gross return of 7% is no more than 1.2% net real. Whereas with 0.3% annual fees, the return net of fees would be 4.2% after inflation — 3.5 times as much.

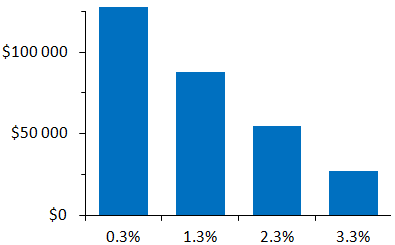

This little calculation is actually misleading ... the difference is in fact even greater (because returns are compounded). The figure below shows that, on an investment making 7% per year, if you pay an annual fee of 3.3% instead of 0.3% the gain is divided by almost five! The latter returns about as much as a savings account (but with considerably more risk). These are (superficially) similar investments, investing in the same asset class, in the same markets, etc. and yet in the end the difference is immense. Do not expect to make money with investments that have sky-high fees.

Figure 1: Purchasing power gain on $100 000 invested for twenty years as a function of the level of annual fees (gross return of 7%, inflation at 2.5%).

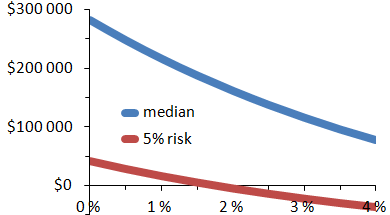

Figure 2 shows in blue the median return on a stock investment as a function of the rate of annual fees. Clearly the more you pay the fund manger, the less is left for you. But the red line also indicates that fees do not only reduce the returns, they also increase the risk. The red line is the 5% risk (what has only a 5% probability of occuring); it corresponds to an annual return of about 1.8% for stocks (i.e. there is a 95% probability to make more than 1.8% per year). But if you pay a 3% fee per year, there is a 95% chance to lose less than 1.2% per year (a loss $22 000 in all). Why? Because when the stock market falls, you continue to pay fees.

Figure 2: Possible purchasing power gain (before taxes) of $100 000 invested in stocks for twenty years as a function of the level of the annual fees.

Choosing an asset allocation can be an exercise in fine-tuning — a little more stock to improve return, but a little less stock to reduce volatility. With fees, however, there is no fine tuning to look for: higher fees mean lower return and higher risk. This is not a matter of personal choice nor of personality: lower fees are better across the board. Period.

NB: Figure 2, based on the S&P 500 for the period from 1871 to 2014, is only intended to indicate the typical effect of fees on the median performance and the risk of an equity investment.

1: Khorana, Servaes and Tufano: "Mutual funds fees around the world", Review of Financial Studies, vol. 22, pp. 1279–1310 (2009). Numbers are for five years investments.

2: De Laulanié (2003), "Les Placements de l'épargne à long terme" (Economica), p. 30.